is property tax included in mortgage ontario

Want to see what homeowners across ontario pay in property taxes on homes assessed at 250000. This is calculated by first tallying the value of all three.

Richmond Property Tax 2022 Calculator Rates Wowa Ca

First if you have a down payment of less than 20 you wont have enough equity in your home for your lender to consider allowing you to pay your property taxes yourself.

. When solely paying as part of the mortgage there is no. In most cases if youâre a first-time homebuyer your lender is going to require that you pay your property taxes through your mortgage. Thats 167 per month if your property taxes are included in your mortgage or if youre saving up the money in a sinking fund.

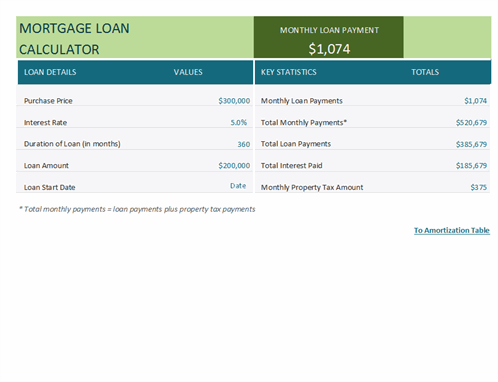

For 2020 the five cities with the highest estimated commercial property taxes per 1000 of assessed property value are. For example a Toronto homeowner with a property valued at 500000 would pay 305507 in property taxes based on the citys rate of 0611013 the lowest on the list. Paying Your Property Taxes In Various Ways If you choose to make your payments through your mortgage the payments for.

You cant invest the money included in the mortgage. Montreal 3699 per 1000. Only the interest portion of the.

Each property owner in the municipality pays a proportion of that 2000 based on their propertys assessed value. Heres how to do that math by the way. This would amount to 58 per year.

So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently changed to 185bi-weekly payment because its not enough to cover the. Rather than having that. Is property tax included in mortgage Ontario.

The rates in Tables 5-8 of the regulation apply to certain business properties in which payments in lieu of taxes are made PILs properties as listed in section 91 of the regulation. Quebec City 3503. Ontario administering the property tax is certainly one of the most importantnot least because the property tax is the single biggest source of revenue for municipalities.

The monthly rent for a 1000 borrowed will be 80. The homeowner can create a savings account and receive interest payments towards paying the property tax. The amount is 6500 per thousand dollars.

Ontario sales tax on CMHC insurance When applicable the cost of CMHC insurance is added to your mortgage balance and paid off over the amortization of your. 2021 Property Tax Value 3055 2021 Residential Property Tax Rate 0611013 2021 Tax rates for Cities Near Toronto Best 5-Year Variable Mortgage Rates in Canada Butler Mortgage 419. The MCAP Property Tax Service is complimentary for all our mortgage holders.

The amount you have to pay in property taxes can add up to be thousands of dollars every year. In order for TD to pay your property taxes we collect a portion of your annual estimated property taxes with each regular mortgage payment. There are two primary reasons for this.

Property tax is included in most mortgage payments. So if you make your monthly mortgage payments on time then youre probably already paying your property taxes. Is property tax included in mortgage Ontario.

When you get a mortgage to buy a home the lender will usually require that you pay the property taxes on the. Contact your mortgage lender to set up tax payments to be included with your mortgage. 05 Oct The Lenders Responsibility To Pay Property Taxes.

Hey all been a while since Ive posted but keep reading and. Hence 4 will be required to be spent.

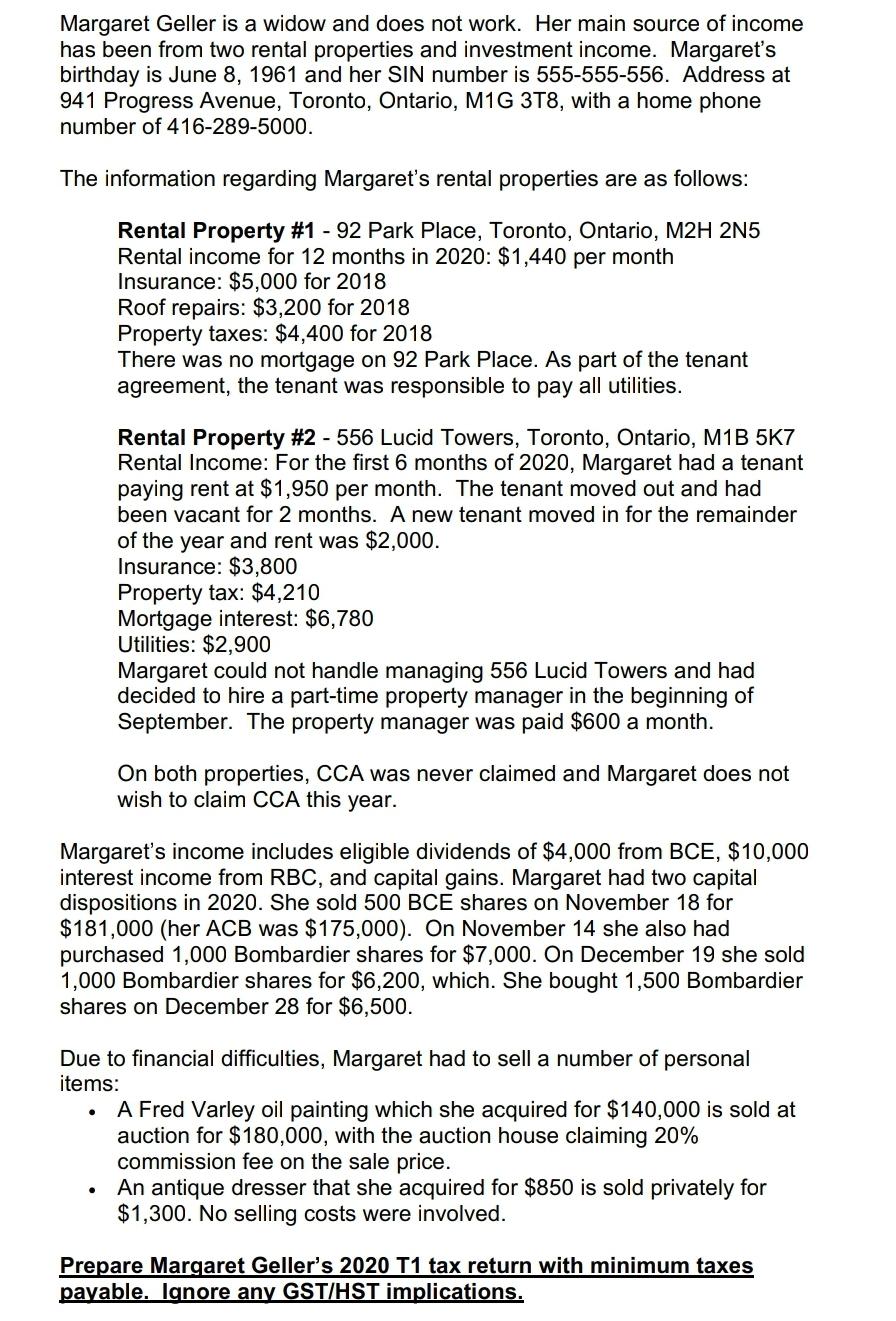

Acct226 Computer Assignment 3 Profile Tax Chegg Com

Property Assessed Clean Energy Programs Department Of Energy

Sergueitroubitsin Only 5 Down In 2020 Live Mortgage Free Live Maintenance Fee Free Live Property Tax Free Your First Year Is On Us Allocation Is Limited For This Amazing

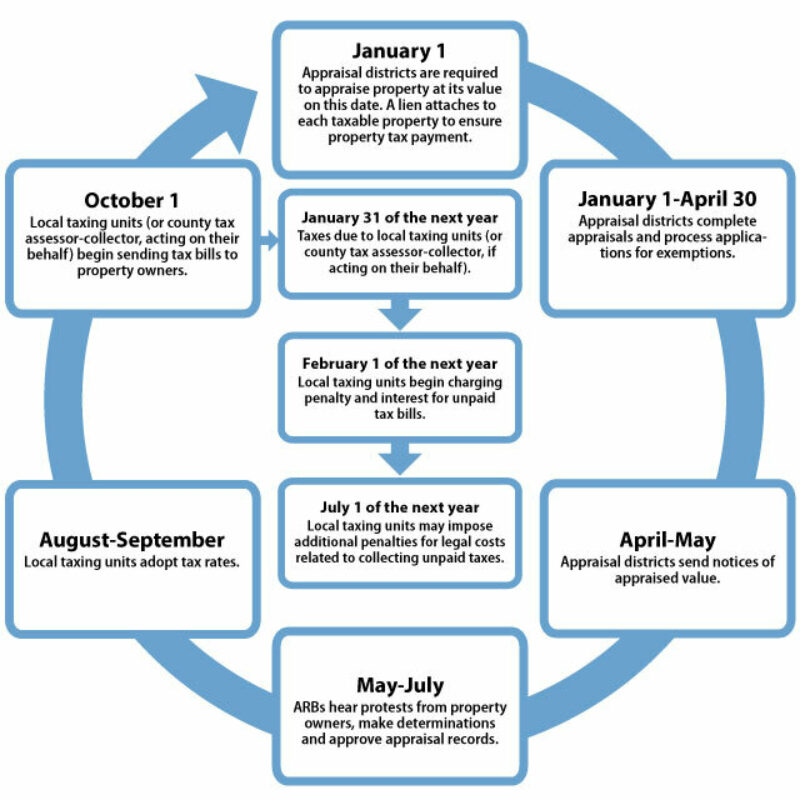

All About Property Taxes When Why And How Texans Pay

What Is A First Mortgage Bankrate

![]()

Property Taxes Included With Monthly Mortgage Payment R Personalfinancecanada

New Tax Law Will Affect Mortgage Interest And Property Tax Deductions

States With The Lowest Property Taxes

Paying Property Tax In Canada Nerdwallet

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Tax How To Calculate Local Considerations

Your Guide To Property Taxes Hippo

Claiming Property Taxes On Your Tax Return Turbotax Tax Tips Videos

Are Real Estate Taxes Included In Mortgage Payments

What S Included In A Monthly Mortgage Payment Ramseysolutions Com

Understanding Your Property Tax Statement Cass County Nd

Frequently Asked Questions About Ontario Property Tax Rates Zoocasa

Coronavirus Property Tax Due How To Cope If Your Short On Money